T. Rowe Price Retirement Plan Services ThirdParty Administrators

250+ claims organizations process invoices from more than 13,000 law firms with Bottomline legal bill review. Bottomline's expert bill review services for self-insureds and third-party administrators claims combine the best in legal e-billing technology with experienced audit attorneys to maximize cost savings opportunities and free up time for.

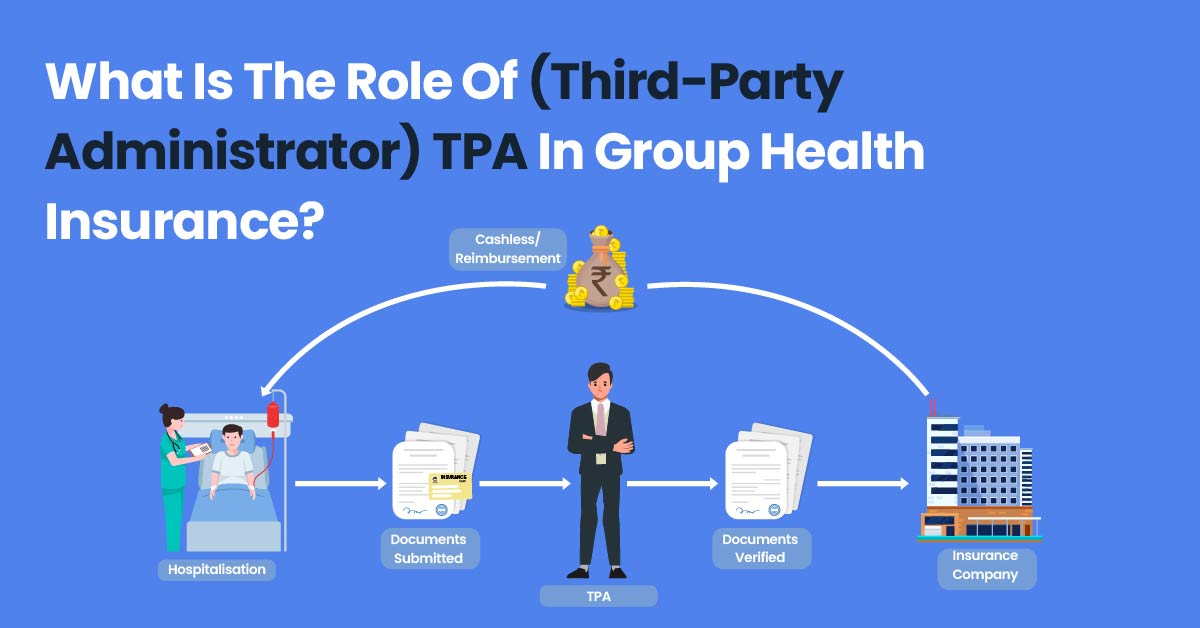

What Is The Role Of (ThirdParty Administrator) TPA In Group Health Insurance? PlanCover

Legal Bill Review (LBR) refers to process of reviewing and analyzing legal bills against any billing guidelines, service level agreements, applicable laws and other generally accepted standards. LBR plays a vital role in litigation spend management through the review and analysis of law firm invoices. LBR is typically accompanied by claims management processes, often outsourced to third.

How to Utilize 3rd Party Billing YouTube

Third Party Administrator Newsletter - January 2021 by: Steven L. Imber , Justin T. Liby , Jennifer L. Osborn , Jonathan K. Lowder of Polsinelli PC - Alerts Monday, January 11, 2021

ThirdParty Administrators What Are They? AgentSync

Process your legal invoices more efficiently and gain greater insight into all of your legal expenses for better cost control. Self-insured organizations and third-party administrators (TPAs) can take control of legal expenses with a secure, web-based solution. Our solution can efficiently process invoices and billing online, analyze data.

Law 206 Ch. 9 Third Party Contracts

CCMSI is one of the nation's leading independent third-party administrators. We have a nationwide presence and are committed to providing exceptional service and support. Call us Toll Free at (800) 252-5059. Home;. This legal bill review program ensures compliance to billing guidelines with best-in-class technology and line-byline review.

What is a ThirdParty Administrator (TPA) in Health Insurance?

Revolutionize Legal Bill Review for Third Party Administrators: 10 Instant Tips to Save Insurance and Healthcare Costs Right Now. As Third Party Administrators (TPAs) continue to play a critical role in managing healthcare costs and legal bills, it is essential to explore innovative strategies that can help reduce these costs while maintaining the high standards of quality expected by insurers.

ThirdParty Administrator (TPA) Definition and Types

:max_bytes(150000):strip_icc()/Third-party-claims-administrator-45a168630e3745d9a05284389911095e.jpg)

Self-funded plans require an entity known as a Third Party Administrator (TPA). The role of a TPA is to coordinate with plan vendors and partners, process pharmacy and medical claims, and ensure that the plan is managed properly. The mission of a TPA is to function as a plan hub that replicates the seamless experience of a fully-insured plan.

3rd Party Fraud Definition and Examples

Third Party Administrators Legal Bill Auditing Trends. View Datasheet. Top Areas of Non-Compliance for Third Party Administrators. 149 Invoices reviewed. 27 Law firms. $464K Invoice value.. Legal Bill Review for Self-Insured and Third-Party Administrators.

ThirdParty Administrator (TPA) Definition, Services, & Selection

Bottomline's legal bill review service itself has 30 years of experience and works with more than 400 P&C carriers, third-party administrators, self-insured companies and corporate legal.

ThirdParty Administrators can Sail Through the Claims Administration Season

In the world of insurance, seamless claims handling and customer satisfaction are key. To assist in the process, third-party administrators (TPAs) provide efficient claims management and administrative services for carriers, adjusters, and policyholders. In this article, we'll explore the functions and advantages of TPAs and shed some light.

Standard Directory of Third Party Administrators Judy Diamond AssociatesJudy Diamond

Understanding TPA Services. A third-party administrator is a business that delivers various administrative services on behalf of an insurance plan, such as a health plan. Third-party administrators are normally called TPAs but, sometimes, they are called "administrative services only" entity (or an ASO) and these ASOs may or may not have a.

3rd Party Billing & VA Benefits Understanding Your NYU Bill YouTube

Bringing over 30 years of seasoned expertise in legal bill review, our solution provides you with an elite team of lawyers, auditors, and specialists. It seamlessly connects with both our Legal Spend Platform or another platform you may have.. Self-Insured and Third-Party Administrators.

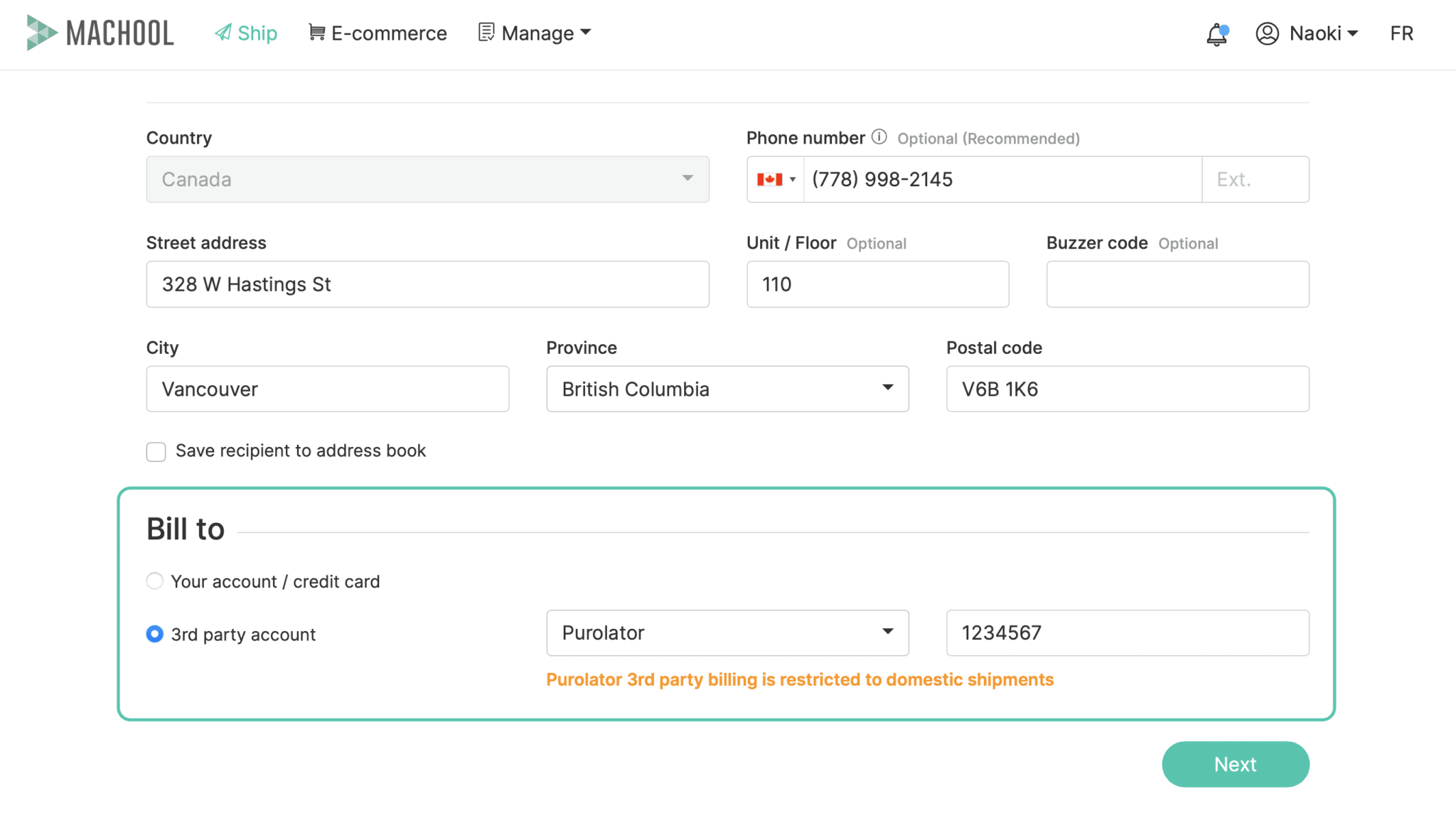

Introducing 3rd party billing Machool

A TPA, or Third-Party Administrator, is an organization that handles certain administrative functions for other entities such as insurance companies, self-insured employers, or health insurance companies. These functions typically include claims administration, record-keeping, and other essential operational work.

The top five thirdparty administrators 2022 Infogram

Bottomline's service boasts a nearly 30-year history in legal bill review, working with more than 400 P&C Carriers, Third-Party Administrators, Self-Insured companies, and corporate legal.

What is a ThirdParty Administrator (TPA) in Health Insurance Ecosystem Ditto

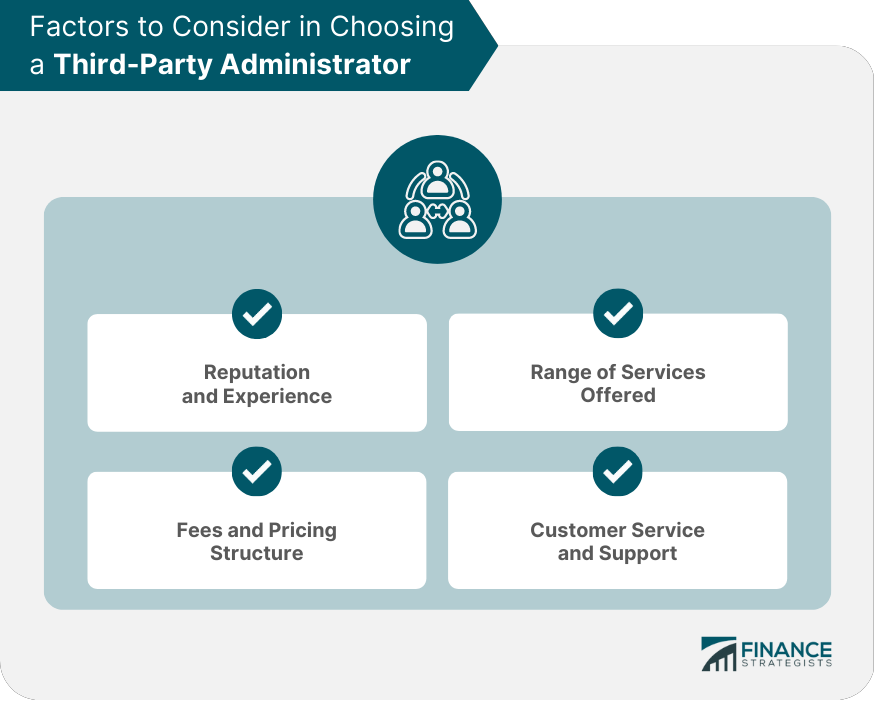

7 Important Considerations When Selecting a Third-Party Administrator (TPA) 1. Weigh bundled versus unbundled programs. Your first step is to decide if you want to go with a bundled or unbundled program. With "bundled" service, a single vendor—often the insurance carrier—acts as the custodian, recordkeeper, and claims administrator.

Growing Adoption Insurance Third Party Administrators in Several Industry Verticals Has been

Largest Third-Party Administrators. Third-party administrators (TPAs) provide claims administrative services to businesses. Many serve mid-sized or large companies that have opted to self-insure a portion of their liability, commercial property, or workers compensation risks. They may also administer claims on behalf of businesses that have.

.